February, 2004

The content management community is abuzz with discussions about what content management is, and what the difference is between all of its various incarnations, including ECM, WCM, DM, KM, DAM, etc. (http://cms-forum.org/?q=node/view/65). The seemingly endless supplier consolidation has done nothing to lessen interest in this question, and there will continue to be consolidation for the foreseeable future even though there will also continue to be new companies and new products and content technologies emerging. What does this ongoing consolidation mean to businesses planning or implementing content management strategies?

This month Bill takes a look at some of the longer term trends behind the recent consolidation. There are obvious reasons some vendors need to “bulk-up” to maintain business models and stay competitive, but there are also more subtle trends underlying much of the consolidation. To fully understand how supplier consolidation will impact your content management plans you need to take a look at these less obvious trends. It is certainly important to understand who owns who, and whether the products are integrated, but it is also critical to appreciate the cumulative effect of consolidation and the influence of larger computing industry trends to be fully prepared adjust your content management strategy as the industry evolves.

Frank Gilbane

You can also download a complete version of this issue that includes industry news and additional information PDF

Content management is a growing and increasingly mature technology, and it is clear from the last two years that there is some significant consolidation happening in the marketplace. This is not to say that the content management market is slowing, or there is no room for new companies, new products, or new ideas. But it is clear from all the recent mergers and acquisitions that existing vendors are finding a need to be bigger and offer a broader platform.

At the very least, the M&A activity shows that vendors seem to want to market a product that covers more than a single content type. As recently as two years ago, we had defined Enterprise Content Management (ECM) as a set of technologies that included Document Management (DM), Web Content Management (WCM), and Digital Asset Management (DAM). At the time, these seemed to be the content types that were demanding the most technological improvement and innovation, and also seemed to be somewhat resistant to a clear return on investment in technology.

The industry seemed to adopt this view of “enterprise” content management, and vendors began to build out their offerings to incorporate and manage more of these target content types. In many cases, vendors realized that mergers and acquisitions would be a shorter path to a broadened platform. This was especially true where the target technology—DAM, for example—was fairly specialized and had expensive barriers to entry. Thus, the activity that had ECM vendors merging with or acquiring DAM vendors—Documentum and Bulldog, Interwoven and MediaBin, Stellent and Ancept, and INSCI and WebWare.

Other mergers and acquisitions may not have been driven by high barriers to entry but simply by the perceived need to bring more features—and more quickly—to the market. This time-to-market focus explains the efforts of, for example, OpenText, which began to round out its DM- and collaboration-centric platform in late 2003 by first acquiring WCM vendor Gauss and then archiving-focused vendor IXOS a week later. It also explains Vignette acquiring document management and archive vendor Tower Technology in January 2004.

Viewed this way, ECM becomes not just an umbrella term for DM, WCM, and DAM, but instead encompasses all unstructured and semi-structured assets within an organization. Thus, scanned images, electronic forms data, and email are thrown into the mix, as is records management and the long-term archiving of documents. These “fixed assets” are perhaps newer (or older!) territory for the typical Gilbane Report reader, who has typically represented the “live” assets of DM, WCM, and DAM. Yet this is exactly how a company like FileNet views the marketplace. Coming from the “fixed assets” end of the market, FileNet has been adding the management of live assets, partly by building out their platform and partly through acquisitions such as their purchase of WCM vendor eGrail in April of 2002.

Such an all-encompassing view of content does seem to eliminate the silo problem, at least at first glance. After all, if you have one piece of software managing all content, you should have one silo, right? One could argue, then, that the acquisition of Documentum by hardware storage vendor EMC is the logical conclusion of this argument. EMC seems to be suggesting that not only can this all be done by one piece of software, but EMC will provide the hardware too—one stop shopping for all your content management needs. (By acquiring enterprise backup company Legato in advance of acquiring Documentum, EMC seemed to be solving that problem as well. As a colleague once joked, “The problem is solved. We can all go home now.”)

Yet Gilbane Report readers will note that this level of integration has typically proven to be only partially complete. Indeed, in many of these cases, the software vendor has only been acquired; the various products have not yet been knit together in a cohesive platform or product offering. Moreover, integration is more than just having an all-encompassing content model. It also means integrating various data sources beyond the content and metadata itself.

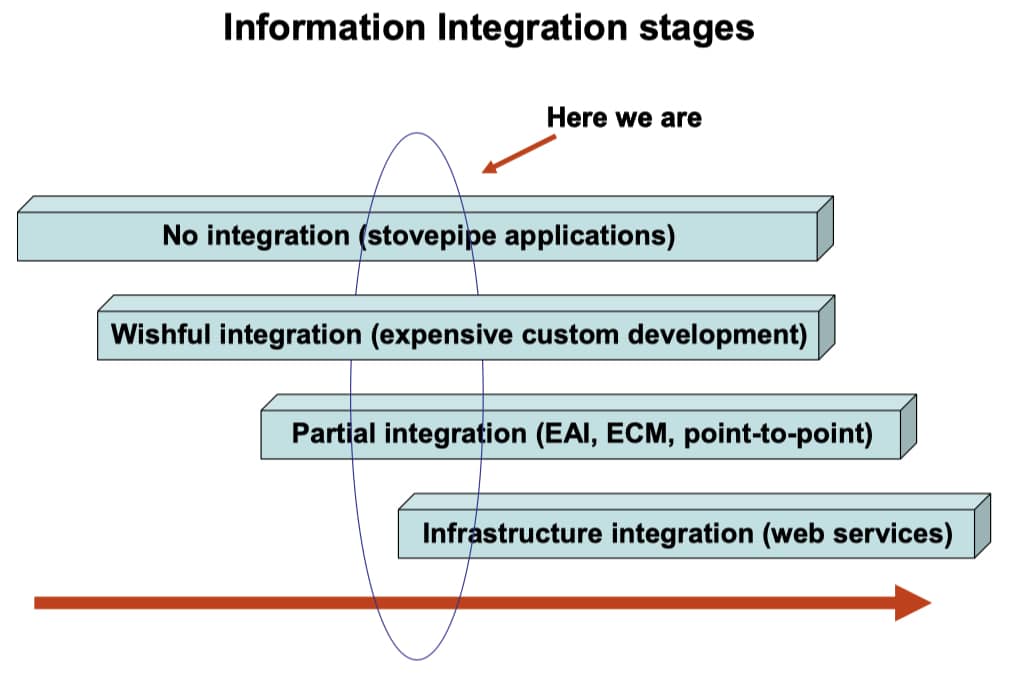

As we have illustrated in the past, content management has moved in stages of integration, from the least integrated (stovepipe or silo applications) through custom integration, and now various levels of ECM. Yet even ECM stops short of bringing all content sources together, thus the emergence of Enterprise Content Integration (ECI) vendors such as Context Media, Venetica, and Day Software, as well as the existence of various “connectors” to tie one content repository to another. The next stage of integration seems to be the desired target, where ECM is one of many enterprise infrastructure pieces are tied together by something like Web Services.

Figure 1. Stages of information (or content) Integration

The Infrastructure Question

So the urge to offer a broader platform is not the only factor driving the consolidation of the market. Indeed, ECM vendors now have at least two fundamental pressures driving their product roadmap. On the one hand, the need to support more content types is part of a broader push for vendors to add more functionality to their products. On the other hand, vendors feel just as much pressure—perhaps more—to ensure that their products conform to the standard programming methodologies and platforms—namely J2EE and .NET.

The Meta Group, among others, has consistently made the point that the “silo” mentality of earlier content management systems added to the cost and complexity of integrating content management with other applications. A more integrated ECM suite, then, would seem to satisfy the need to look beyond the silos to a more unified product suite and architecture.

In fact, the architecture wars, if we can call them that, complicate the ECM landscape even more than the feature wars. To begin with, there is significant overlap between ECM platforms and other infrastructure technology, such as that for portals and enterprise application integration (EAI), and even with core technology such as application servers. Moreover, many of these overlapping technologies are trying to claim a bigger piece of the enterprise computing pie. Thus, application server companies such as BEA and IBM try to carve out more of the application “stack” for themselves, portal companies add content management functionality, and the line between data integration and content integration blurs.

The October 2002 acquisition of portal vendor Epicentric by Vignette can thus be viewed through this architecture lens, as can a deal such as the acquisition of portal vendor Corechange by OpenText in early 2004. Nor is it surprising, then, to see Plumtree offer Plumtree Portal Server with the tag line, “Publishing Across the Enterprise Web” or to have BEA include its Virtual Content Repository with WebLogic Portal. (Moreover, searching for “content management” on BEA’s site yields 7320 hits, with the majority of them being returned from BEA’s excellent developer site, dev2dev).

Service-Oriented Architectures

However, here again, the architectural issues complicate the landscape—and also have the potential to radically change things. Service-oriented architectures (SOAs), for example, could leapfrog everything that is currently in place for many of these vendors. SOAs are, in short, an increasingly standardized method for integrating software as services; in this way, software and content are made available over the Internet through standardized, XML-based discovery and messaging protocols. Using SOAs, software and content services can be straightforwardly integrated with other services. Typical examples include a software service translates text into other languages and another one that converts a document from one format to another.

SOAs are part of the broader momentum toward the loose coupling of applications and data. As more business processes and applications move to the Web, organizations need to quickly and efficiently bring content and applications to the very thin client provided by browsers. Just as XML provides a standardized layer for data transfer, SOAs are giving developers an open means of having software communicate with and control other software over the Internet.

Macro Factors

Clearly there are some large factors at work here as well.

- The Gartner Group has written recently written about the increasing concern about compliance requirements such as Sarbanes-Oxley. If such concerns are rising among senior executives, then the visibility of content management will also rise, prompting executives to look at larger, more viable (in their eyes) vendors to solve this key problem. This analysis would suggest as well that larger vendors such as IBM and Oracle would play an increasingly important role in the content management space.

- Organizations and executives are also recognizing the value of content. Value is obvious to companies where the content is the product (publishing and entertainment), but perhaps less obvious where content supports the larger organizational mission. Yet as companies look more closely at applications such as customer relationship management and customer support/call tracking, the key role of content in such applications is clearly emerging. As organizations recognize the trapped value in content, the assets are viewed as more strategic. Having these assets managed by a larger, more recognized enterprise software vendor also makes more sense to the CxO.

- Tony Byrne of CMSWatch points to the need for ECM vendors to get bigger as a way of maximizing their resources in lean times. A larger organization, Tony reasons, can leverage engineering and marketing resources in such a way to develop stronger, broader products.

In fact, all of these pressures and trends are likely coming to bear. Companies are increasingly concerned about compliance, and smaller vendors are hard pressed to make maximum use of resources. In addition, at the Gilbane Report, we have long pointed to a more comprehensive view of content and data automation and integration. Such Enterprise Information Integration, or EII, recognizes that the coupling of content and data, together with logic and presentation, will comprise the most effective and highest-impact applications moving forward. All of these factors argue for a more comprehensive platform offering.

Content management seems to be following the same trend that software has followed for many years—that is, what exists as a separate application today at some point becomes a feature in a larger application. In the days of shrink-wrapped applications, this trend was usually accurate and easy to track. At one point, for example, spell-checking software was a separate application and then was built as a feature in many applications (word processing, email).

More importantly, the trend suggests, what was once a separate application and is now a feature of larger applications becomes part of the operating system. Thus, spell checking in Windows applications can be implemented through a set of APIs and libraries provided by Microsoft. But what happens as the operating system gives way to the network as operating system? The answer, of course, is Service Oriented Architectures.

In fact, the underlying impetus of many of the mergers and acquisitions ties many of these underlying pressures together in a way that is then addressed by SOAs:

- How can ECM vendors merge and quickly tie together their disparate applications into a single architecture? SOAs.

- How can a large organization with many disparate systems tie them together in such a way to give management (and auditors) visibility into key documents and business processes? SOAs.

- How can even smaller organizations give employees, customers, and partners access to enterprise content assets? SOAs.

If you look closely at many of the acquisitions and mergers, you will see that an SOA message is emerging at the same time as the message for the combined product lines. Indeed, some of the acquisitions were likely driven by the perceived need to acquire SOA-based technology and expertise; the acquisition of DAM vendor WebWare by INSCI comes to mind. In other cases, the ability of the products to be integrated via SOAs was likely seen as a way to quickly integrate the newly acquired technologies.

Conclusions

It is tempting to simply say that SOAs are the answer to everything. Oh, if life were so easy! In fact, organizations still face all of the hard work of capturing, creating, managing, and distributing content. Legacy content and systems still exist. Material still needs to be digitized, structured, and enhanced. Organizations still need to design and maintain data and content models that support a wide array of processes and systems. Business processes and workflow still need to be understood, documented, and supported. Content still needs to be indexed and enhanced so that it is readily available to an array of organizational constituents.

Still, SOAs loom as a potential accelerant to all these processes and solutions. Developers are hard pressed to quickly deploy solutions that have an impact today and that will hold up over time. The early indications are that SOA-based solutions are less expensive and faster to implement. After years of grappling—and ultimately failing—with previous software integration technologies, SOAs may provide developers with the workable solution they have been seeking.

Continued consolidation should be expected as the content management industry marches toward maturity. At the same time, the number of emerging and established companies, including platform and infrastructure suppliers, building new and enhanced products for solving specific content management-related problems will keep on growing. This is good news – businesses need to keep up with the rapid pace of development and consolidation, but they are increasingly able to implement solutions that provide dramatic benefits to both the top and bottom line.

Bill Trippe