Our last issue described what we believe to be the single most important mega-trend in computing, and how this mega-trend manifests itself in today's top 10 trends in content management. This month we follow up with a peek at some research into the fundamentals of the information management market being conducted by colleagues at the MIT Sloan School.

Jared Spataro and Bryan Crow have looked at over 400 software vendors including 132 who position their solutions as "content management platforms", and dozens (to date) of companies who are implementing these solutions. The goal is to come up with a framework for understanding the market landscape and for predicting market evolution. Jared and Bryan have come up with a compelling and enlightening way to view the market dynamics. Their full report will be a must read for software vendors, market analysts, and IT strategists. In addition to the partial executive summary published here, Jared and Bryan will be presenting their findings in the Content Management Vendors session at the Gilbane Conference on Content Management @ Seybold in San Francisco in September. We would love to hear your reaction and hope to see you at the conference, but don't wait to let us know what you think; Send us an email.

Information is being produced faster today than ever before. But our ability to produce information has far outpaced our ability to manage it. In response to this asymmetry, an entire industry is emerging to provide solutions to a world literally drowning in bits and bytes. Today's content management industry is really the precursor to a broader trend in information management (1.). The market is shifting from early roots in document management and web content management to a search for an answer to the broader author-consumer problem: "the right information to the right person, at the right place, at the right time, and in the right format."(2.)

For all its efforts to provide a solution to information overload, however, the emerging industry has struggled to bring order to the chaos created by its own vendors and analysts. Anyone who has tried to get their head around the landscape can attest that the market is downright confusing. In order to provide some insight into this dynamic space, we are working together with The Gilbane Report to produce a comprehensive study of the industry. Our research and analysis involves more than 400 independent software vendors and includes on-going work to produce 100 case studies at organizations at various stages of implementing solutions. In this article we provide an advance executive summary of a select part of our results, specifically focusing on

Communication is the killer app. On more than one occasion The Gilbane Report has proposed that communication "is replacing data crunching as the predominant job of computing." (3.) Our research corroborates this hypothesis. In order to more richly model the implications of this premise, we profiled hundreds of software vendors and large organizations and used the data to create a framework that describes the broader information management market. The resulting series of models provides a useful way for thinking about the forces that have shaped the market and the trends that will drive the future.

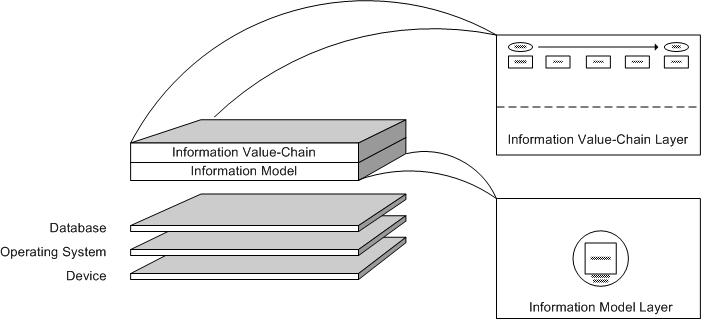

Devices, Operating Systems, and Databases have evolved over time to provide layers of abstraction to support the shift toward communication-based computing. At the most basic level, today's content management technologies are focused on solving the author-consumer problem: moving information seamlessly from the creator to the intended audience. But in order to facilitate this process, two important layers of abstraction have taken shape on top of the database (Figure 1 ) (4.). Relational databases provide significant power over transactional data through rows and columns, but they have lacked critical functionality for managing other types of content. Accordingly, The Information Model has emerged (largely in the form of XML) to form the basic architecture for managing context-sensitive information, providing concepts and tools to define and manipulate content. The Information Value Chain Layer has leveraged these innovations and extended the functionality necessary to practically move content from author to consumer.

The Information Model is the ultimate content management tool (5.). Put simply, the Model brings structure to unstructured data by wrapping an information payload in structured metadata, creating an atomic unit called a content component (Figure 2) (6.). This simple abstraction defines a powerful context-rich structure for managing a basic unit of context-sensitive information. Building on this content component architecture, independent software vendors have developed Content Enrichment applications-— programs designed to leverage the value of the Model through association, analysis, search, and digital rules management (Figure 3). Many of the earliest notions of content management (search and simple hierarchies) were based directly on the Information Model.

Leveraging the concepts and tools provided by the underlying Information Model, The Information Value Chain has emerged as a series of steps that provide the functionality necessary to move content from author to consumer (Figure 4). The dashed line in the figure represents a line of demarcation between transactional data and content, in reality less an architectural boundary than a marketing divide (7.). Software and services have evolved with time to deliver value at each link in the chain, creating an interesting dynamic among firms competing for influence in the market.

Creating the models that led to the framework above was interesting. But the real value in the exercise has been mapping both vendor and customer data back onto the landscape and tracking the trajectories of individual organizations over time. By analyzing the complex interactions between firms and the market, we have been able to uncover several important trends. We present two of those here.

Of the nearly 400 independent software vendors we profiled, more than 35% positioned themselves as "content management platforms." Despite consolidation over the past 12 months, competition is intense. As a result, management vendors have been scrambling for ways to stand out. Analyzing our data, we found four strategic directions for effective differentiation.

Value Chain Differentiation

Basic business strategy dictates that market power can be increased by gobbling up links on the value chain. By looking to the right and the left, as shown in Figure 5, management vendors have attempted to differentiate themselves by integrating functionality at Create, Integrate, and Distribute.

Information Model Differentiation

Strengthening content enrichment capabilities (association, analysis, search, and digital rules management) has added another dimension to solution differentiation. Both Documentum and Interwoven recently announced new support for classification technology, for instance. We expect vendors to increasingly turn to the Information Model layer of the framework for additional functionality to set them apart from the crowd.

Distribution Differentiation

Our interviews with organizations looking to purchase or build management solutions uncovered a key insight. Instead of thinking about solutions in terms of popular vendor buzzwords (web sites, portals, WAP, palm-computing, print, or syndication), these businesses tended to think about their problems in terms of target audiences and modes of communication. Figure 6 shows a simple matrix that emerged from our analysis, plotting "the how" of communication vs. "the who." This model of the Distribute step of value chain provides another effective means for firms to position and differentiate themselves, and provides significant insight into some of the forces that will shape the landscape moving forward.

Industry and Business Application Differentiation

Industry expertise and Business Applications provide a final axis of differentiation. By focusing on specific vertical markets and providing solutions targeted at line managers rather than IT staff, vendors can identify lucrative market segments and position offerings to meet the unique needs of the target group.

The term Enterprise Content Management has become a buzzword in the CM industry. The Gilbane Report has described the idea of ECM as "content management that goes beyond Web publishing to manage all enterprise content for all enterprise applications." (8.) Much of the marketing communication from leading vendors and analysts implies that companies will want to use a single vendor for all of their CM problems. We believe this is unlikely.

Large corporations are comprised of multiple organizations that handle information in their own way. These departments have separate needs and budgets. Our research points to the idea that one of the big challenges in selling any system on an enterprise-wide basis is the nature of the corporate environment. Determining whose budget gets hit, getting approval from multiple departments and management layers, coordinating training and many other difficulties make successful enterprise-wide sales and implementations a Herculean task — and a rarity. This may seem rather obvious to the casual observer, but it flies in the face of most of the rhetoric out there at present.

One implication of this is that companies will likely end up with multiple content management systems sold on a departmental basis. Thus, rather than solve the problem of widely disbursed and fragmented content, content management systems could serve to promulgate it. Many vendors have emerged around the idea that rather than having one central repository for all information, corporations will have many repositories that will need to be integrated. We believe that the integration step in the value chain will become increasingly important as companies adopt multiple CM systems and then try to integrate relevant information from these and other systems.

What does all of this mean for vendors and their strategies moving forward? We believe that the answers to that question are what make this framework so powerful. In this section we will discuss how some of the leading vendors fit into the framework and the implications of the trends described above. In the interest of space, we will specifically focus on the Manage and Integrate steps of the Value Chain.

It's important to emphasize that the information management industry is extremely complex and dynamic. The vendors highlighted in this section are not meant to provide an exhaustive list of solutions. We are trying to show how vendors can be mapped onto the framework to help us make sense of this complex and often-confusing industry. We recognize that vendors are continually updating their offers and that the views expressed are not intended to suggest limitations in any of the current or future product offerings.

The manage step is perhaps the most easily recognizable in the chain given that we generally describe the industry in terms of content management. This is where many of the most well publicized firms in the industry dwell. Figure 7 depicts where the current ECM vendors reside on the value chain and the ways in which they are seeking to differentiate themselves. It might appear from the figure that these companies have identical product offerings. That is not the case; in spite of what their communications might suggest. Most ECM vendors come from two entirely different camps. Some, like Documentum, hail from document management while others, like Interwoven, come from web content management. These products were made for different purposes, and while they are both converging now on the idea of ECM, neither is very good at the others' strengths yet.

As mentioned in the trends

section above, companies such as Documentum and Interwoven have often tried

to differentiate themselves through the Value Chain and Information Model. As

shown in the figure, these companies frequently expand their offerings by moving

in both directions along the Value Chain and by providing enrich functionality

in the Information Model layer. Virtually all of the major ECM vendors have

partnered, developed, or merged their way along either side of the Value Chain,

and we hear about new deals in this vein almost daily. We believe this trend

will continue.

Not all content management vendors are taking the same approach as the major

ECM vendors, however. Many companies are finding success by differentiating

themselves in other ways. Of the 132 content management vendors we have profiled

and are tracking, less than 5% are actively pursuing Enterprise Content Management.

In fact, by carefully segmenting the solutions available on the market today,

we identified more than 20 distinct horizontal applications of content technology.

These range from collaboration at OpenText, to catalogue commerce at Pindar,

to brand resource management at WebWare.

Our analysis of this phenomenon showed that a key to understanding the evolution of the information management market is the application of the differentiation profile discussed above. Case study data showed clearly that different industries have different information management needs. More importantly, it pointed to the fact that businesses are evaluating and purchasing solutions based largely on a specific problem rather than a broad need for content management. In this context, the positioning of OpenText, Pindar, and WebWare underscores the value of the differentiation profile as a systematic way to evaluate both market segments and vendor positioning. By creating a unique profile of Value Chain, Information Model, Distribution, and Industry/Business App differentiation, these vendors have identified and targeted lucrative market segments.

Even more intriguing, our analysis led us to conclude that "Enterprise Content Management" is nothing more or less than one of many such market segments defined by a distinct profile. Although ECM has often been billed as a category killer, the true size and viability of the segment remains to be seen. In fact, from a competitive standpoint, pursuing ECM may be a classic case of more being less. Trying to be all things to all people is a strategic risk that-if left unmitigated — can waste resources and dilute true competitive advantage.

As crowded as the manage step in the Value Chain appears, the integration step may be even more so. We have identified over 250 integration software vendors, 53 of which we have profiled and tracked in our model. There are literally dozens, if not hundreds, of applications, content types, operating systems and other platforms that companies try to integrate. In fact, in some cases, we found more than 25 different solutions involving content and data integration co-existing in the same company. From ERP, CRM, and legacy systems to various content repositories, the idea of integration can be daunting. We could write an entire article on this space and the trends going on there. Our intention, however, is simply to give you a taste for how these vendors might play in the information management space and to show you how they map onto the information Value Chain.

Many of these vendors provide solutions below what we call the line of demarcation (the content/data divide in The Value Chain layer), specializing in integrating the structured data found in enterprise applications like ERP, SCM, and CRM systems. (This type of integration is often called enterprise application integration, or EAI.) Figure 8 shows how these integration vendors fit onto the Value Chain.

There are already a few companies that have started to focus on content integration. Vendors like Venetica, Day, and Agari Mediaware are betting integration will become increasingly attractive and important as firms combine multiple information repositories (content and data) to provide new business applications. Interwoven, for example, has partnered with Venetica to provide bridges to other repositories. Open Text, for its part, has an SAP connector and recently announced a series of business applications designed to integrate its own repository and ERP data at Siemens. If this type of integration continues to gain traction, we predict that companies like Tibco and WebMethods, who already have a name in structured data integration, will move above the line and offer integration solutions for content.

Information Management, a broad market that subsumes classic enterprise applications (ERP, SCM, and CRM) as well content management, is a dynamic space. As communication replaces number-crunching as the predominant focus of computing, we believe that it will become even more exciting. But the very dynamics that make it interesting have also created problems in understanding the fundamental market forces shaping the emerging industry. While past efforts to explain the market have relied on simple market positioning, we believe that a more sophisticated view of the landscape is required to understand its complexity and predict its evolution. Carefully analyzing vendor and market data in the context of the framework introduced in this article can yield important insights into what we can expect in the future.

Jared Spataro,

jared@gilbane.com, jared.spataro@sloan.mit.edu

Bryan Crow, bryan@gilbane.com, bcrow@mit.edu

1.

For the purposes of this article, the term information is used to denote any

digital representation used to communicate ideas. Information is divided into

content (context-sensitive information) and data (also known as transaction-based

information). The terms structured data and unstructured data are defined in

Footnote 5 and cannot necessarily be used interchangeably with content and data

respectively.

2. A common market rallying cry, reiterated by Greg Peters, CEO of Vignette

in his Keynote Address, AIIM San Francisco, March 2002.

3. "Why

Content & XML Integration Technologies Are Fundamental", The Gilbane

Report, Volume 9, Number 6, and "The Top Ten Trends in Content Management",

Volume 10, Number.

4. Because of the number of illustrations, we break from our normal practice

of including them in-line in order to maintain the flow of the text.

5. "What is an Information Model & Why Do You Need One?", The Gilbane Report, Volume 10, Number.

6. In this context, we refer to structured data as information stored and managed in a rigorously de-fined format; unstructured data is simply used to denote information lacking such a format.

7. In the model, we distinguish between data that can be managed efficiently with a relational data-base below the line and content that requires context and additional layers of abstraction above.

8. "Editorial Interfaces & Enterprise-enabled Content", The Gilbane Report: Volume 9, Number 7.

Figure 1. The Big Picture

Figure 2. The Information Model Layer

Figure 3. Content Enrichment Applications

Figure 4. The Information Value Chain

Figure 5. Value Chain Based Differentiation

|

Firm External

|

|||||

|

Firm Internal

|

Suppliers

|

Partners

|

Customers

|

||

| One Way |

Publishing

|

- Employee intranets - Employee publications |

- Supplier extranets - Supplier exchanges |

- Support resource site - Marketing resource site |

- Firm/product web site - End-user support - Other publications |

|

Access

|

- Records Management - Digital asset mgmt - Knowledge Bases |

- Contract/PO Repository - CAD/CAM Repository |

- Support materials - Marketing collateral - Market intelligence |

- Product updates - Support materials |

|

| Two Way |

Real Time

|

- Conference calls - Online meetings |

- Inventory management - Product development - Product marketing |

- Inventory management - Remote training - Product development - Product marketing |

- Remote support - Remote sales |

|

Asynchronous

|

- Product development - Product marketing |

- Supply chain mgm't - Product development - Product marketing |

- Inventory management - Remote training - Product development - Channel management |

- Next-Generation CRM Interactive Relationships |

|

Figure 6. Distribution Differentiation

Figure 7. ECM Vendors' Moves Along the Value Chain

Figure 8. EAI Vendors' Predicted Moves